Difference Between Investment And Gambling In Tabular Form

(Newswire.net- May 19, 2017) - You hear a lot of people bashing investment in the stock market. These individuals tend to describe Wall Street as a casino, and stock investment as gambling.

Think investing is the same as gambling or scratching off a lottery ticket?

- The Difference Between an Investment and Gambling Sara Williams May 19, 2017 People who try to use money to make more money are always presented with risk.

- There is often some confusion between the terms investment, speculation and gambling. This confusion is often linked with investments made in the stock market. Investing is NOT gambling. Gambling is putting money at risk by betting on an uncertain outcome with the hope that you might win money.

- TABULAR bFORM/b difference between investment and speculation and gambling br in tabular bform/b abs gambling. B2014/b gambling act compulsive gambling bipolar. Fill & Sign Online, Print, Email, Fax, or Download.

Many people are nervous about putting their money in the market and hesitate because they believe that investing has more to do with luck than anything else.

In other words, they believe their ability to earn a return on their investment comes down to pure chance—like the flip of a card or roll of the dice. Investors and gamblers do have one thing in common: They both want to put more money in their pockets.

Investing vs. gambling

Investing and gambling could not be more different.

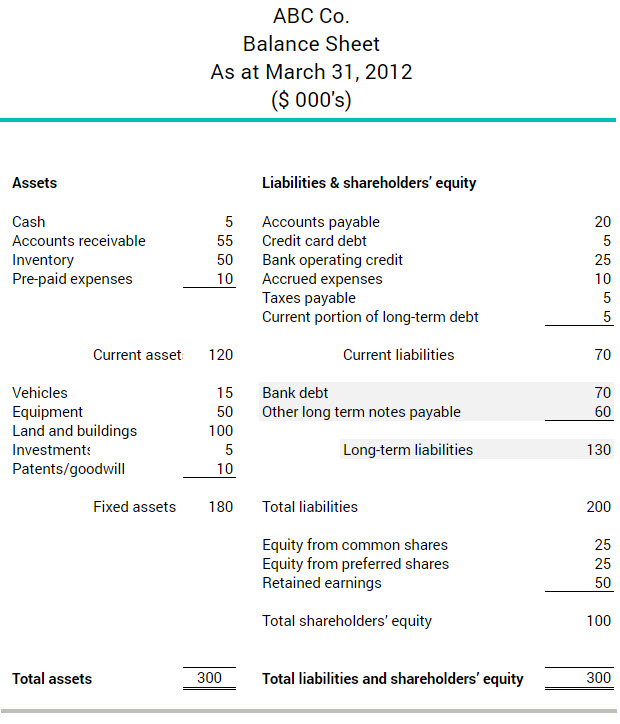

| Investing | Gambling |

|---|---|

| You control your risk. You can invest according to your goals and timelines: Conservative, moderate or aggressive. | Risky. The odds are always in favor of the house. |

| Strategy: Slow and steady. Investors plan to make a consistent return on their investments every year. | Strategy: Fast money. Gamblers bet it all for the chance to make a bundle fast. |

| Taxes: By putting your money in a retirement account, you can defer paying taxes on your investment earnings. | Taxes: You have to pay taxes on any gambling or lottery winnings over $600 |

Here’s why investing your money is typically a better option for those looking to increase their wealth, rather than buying a lottery ticket, or going all-in with a pair of jacks:

The odds are in your favor

Anyone familiar with gambling has likely heard the phrase “the house always wins.” Since casinos are in the business of making money for themselves, that means the scales are tipped in favor of the dealers.

Investing is generally a much more effective way of making your money work for you. And most importantly, investors have a lot more control in where your money goes and how it can grow.

Gamblers hope for a quick win. Investors want to build wealth over time

For example, if you bet $1,000 that the roulette wheel hits your lucky number, you’ve got one shot at cashing in. Your odds? 35 to one. That’s a risky bet. And there’s a good chance you’ll walk away from the casino with less money than when you walked in.

Understanding risk

Investing involves risk. But by building a diversified portfolio with stocks, bonds, and holdings from multiple sectors (tech, energy, etc.), you can balance out your risk. In other words, you’re not betting it all on one investment—or putting all of your eggs in one basket.

If one investment goes down in value, you’ll have other investments that may hold steady, and keep your portfolio afloat.

For example, numerous advisers say an effective way to manage your money is by applying aspects of Modern Portfolio Theory (MPT). Nobel Prize-winning economist Dr. Harry Markowitz conceived the idea for MPT which formed the foundation for portfolio management by balancing risk and return.

The general idea of MPT is that by investing in a diverse assortment of stocks, bonds, and other securities in a multitude of countries, you can minimize risk.

Invest with a plan

You’ve probably seen news reports about people who win a lot of money at the casino or by playing the lottery. These make it seem like a lottery win is not only possible but probable. Unfortunately, it’s not. Losing is nearly inevitable when you gamble.

Gamblers hope for a quick win. Investors want to build wealth over time. Fast money sounds great but it isn’t an actual plan to get you to your goals.

Rather than just “win big,” many investors have a specific plan as to what they’re investing for in the long term. This goal, whether it’s saving for a down payment or a child’s college education, should align with your investment strategy.

Once you have a plan in place, you can adjust your portfolio according to your timeline.

The power of compounding

By choosing to invest your money with a solid strategy you can allow your assets opportunity to compound over time.

Here’s how compounding works:

Say you start putting away $50 a week in an investment account that owns a variety of stocks, bonds, and cash. If that account earns an average of 5% annually, you’ll have over $159,669 in 30 years when the interest is compounded annually.

Investing, simplified

Start today with as little as $5

Get the AppRecognizing the differences between saving, investing, and gambling will help you compartmentalize each, and avoid common mistakes. It’s an easy mistake because not enough people think it through, and the terms are used interchangeably in our culture. Keeping saving, investing, and gambling three separate activities in your mind and in your account structure will help you be more successful at managing your money and growing your wealth.

What is Saving?

Saving is the act of preserving income for a future use; or an amount of income that is not currently consumed. Very simply saving is income that is not spent or put at risk.

In other words, saving involves money put aside for the future with capital preservation the primary goal. It’s possible to save toward investing activities. For example, you may want to transfer money from savings to investing when your emergency and short term goals become fully funded.

Examples of Saving would be: Bank Savings Account, Money Market Mutual Fund, CDs, U.S. Treasury Bills or Savings Bonds.

Items you might be saving for: An emergency fund, a car, or an event such as a vacation or wedding.

What is Investing?

The act of placing money in risk assets expected to grow from producing a product or service of benefit to others. Investing generally involves putting the original investment at risk with the hope of higher returns than savings.

Investing is having a claim on an entity that produces a product or service with the goal of profit and the risk of loss. Investing is different from saving because your investment is at risk. While there are many different levels of risk an investor may be willing to take; the primary goal of investing is not preservation of capital but long term wealth building. The best investments have growing cash flow and divide an expanding “pie” among the stakeholders.

Examples of Investing: Individual stocks, bonds, most mutual funds, most ETFs, etc. Real Estate used as rental property or for production of goods and services. Buildings such as factories, office space, retail space, etc.

Investing involves the possibility of profits and losses based on performance of the asset.

Example of Difference Between Saving and Investing

Here is an example where the same asset can be saving or investing depending on where it’s placed. A money market fund can be saving in your emergency fund account, but it also can be investing if located in your investment portfolio account.

A money market fund within your investment portfolio should be treated differently than a money market fund for short term savings. The money market in your investment account serves the purpose of lowering portfolio asset correlation and can be used to buy risk assets when opportunities arise. A money market in your emergency fund is for capital preservation and should not be touched unless you have an emergency.

What is Gambling?

Gambling is accepting risk based on chance. Almost all gambling involves risk that exceeds the expected reward. In other words, gambling usually involves dividing up a fixed pie among winners and losers based on chance. In most gambling there is an additional factor such as costs, fees, or odds that results in dividing a shrinking pie.

Examples of gambling:

Currency Trading of Futures and Options (except hedging), Commodity Futures and Options Trading (except hedging), All Lotteries, and Casino games such as cards, table games, or electronic games.

In all these examples the odds are against you because they divide among the “winners” a smaller pie than originally existed!

Difference Between Investing and Gambling

Difference Between Investment And Gambling In Tabular Form Pdf

Some people confuse investing with gambling. This is one good reason it’s important to differentiate and compartmentalize saving, investing, and gambling. Most gambling involves risking capital and dividing a fixed amount among winners and losers based on chance. This is different from investing where you place your money in an asset expected to increase in value over time.

Additional Reading:

10 Investing Principles Fundamental To Successful Outcomes

Difference Between Investment And Gambling In Tabular Form Example

The Importance of Compartmentalization

Investors frequently get in trouble because they fail to differentiate and compartmentalize these three very different activities. An emergency fund should be kept completely separate from your investing activities. As pointed out, even if you have the same asset (i.e. Money Market Fund) in each they need to be viewed and treated differently.

Saving is a passive activity for short term goals. Preservation of capital is the primary goal. A separate account for each goal or activity promotes correct thinking and actions consistent with meeting the goals of the account.

Investing is an active activity and keeping accounts separate from saving accounts keeps the asset allocation and diversification process clear and separated from the fund reserved for capital preservation. Keeping funds separate is sound planning and a risk management concept.

Gambling should never be mixed with saving or investing. If someone chooses to gamble it should be with entertainment monies unassociated with saving or investing accounts. Only monies that individuals are willing to lose should ever be wagered in a game of chance.

Difference Between Investment And Gambling In Tabular Formation

Keeping saving, investing, and gambling three separate activities in your mind and in your account structure will assist you in building wealth. Too many people gamble with investment money, or invest when they should be saving. Differentiating and compartmentalizing saving, investing, and gambling, is an important first step to a successful investor.

Discover, Compare, and Evaluate Dividend Stocks Without Emotional Bias

Difference Between Investment And Gambling In Tabular Formula

Minimize Large Portfolio Drawdowns

Invest With Confidence in Less Time - Manage Your Portfolio Without Behavioral Errors

Disclaimer

While Arbor Investment Planner has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, or completeness of third-party information presented herein. The sole purpose of this analysis is information. Nothing presented herein is, or is intended to constitute investment advice. Consult your financial advisor before making investment decisions.